Contents:

If you can’t generate enough current assets, you may need to borrow money to fund your business operations. Yes, accounts receivable should be listed as an asset on the balance sheet. To further understand the difference in these accounts, you need an overview of a company’s balance sheet. To gauge the profitability of your business, determine the total of your assets and accounts receivable.

Molecule Holdings Inc. Announces Debt Financing Transaction and Restructuring of Certain Existing Debt and Update on Order Pipeline – Marketscreener.com

Molecule Holdings Inc. Announces Debt Financing Transaction and Restructuring of Certain Existing Debt and Update on Order Pipeline.

Posted: Tue, 11 Apr 2023 13:16:11 GMT [source]

The accounts receivable turnover ratio is a simple financial calculation that shows you how fast your customers are at paying their bills. When you have a system to manage your working capital, you can stay ahead of issues like these. Calculating your business’s accounts receivable turnover ratio is one of the best ways to keep track of late payments and make sure they aren’t getting out of hand.

Business

Company bookkeeping may require your firm to post dozens of receivable transactions each week. Using these, the company’s overall performance and liquidity position can be reasonably estimated. ParticularDebitCreditTrade Receivables ($$$)Sales Revenue($$$)In the case of a cash sale, Cash and Cash Equivalents would have been debited with the sale amount, not Trade Receivables. Here we will use the same example as above but instead, Corporate Finance Institute sells $750 worth of inventory to FO Supplies. The performance of the asset in the 12 months following the modification.

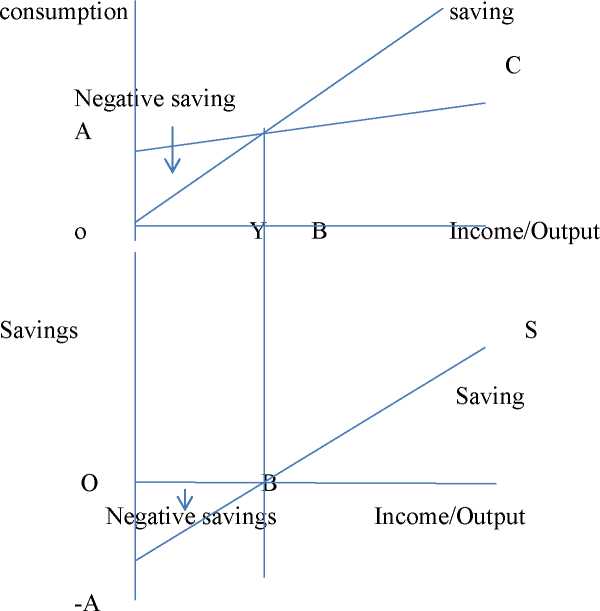

Using this method matches revenue earned with the expenses incurred to generate the revenue, and the process presents a more accurate view of your profitability. The income statement is more reliable when you use the accrual method. Mostly this analysis is considered in terms of evaluating the context of turnover. For analysis purposes, accounts receivable tend to be important because it reflects the company’s overall cash and liquidity position.

Charlotte’s Web Holdings, Inc. (CWBHF) Reports 2022 Fourth … – InvestorsObserver

Charlotte’s Web Holdings, Inc. (CWBHF) Reports 2022 Fourth ….

Posted: Thu, 23 Mar 2023 12:37:00 GMT [source]

On the basis of this invoice, an account receivable is created in the books. A credit period is typically offered within which the customer is required to settle their outstanding balance. Here the principal amount is the amount burrowed by the payee from the issuer.

Accounts Receivable on the Balance Sheet

But if some of them pay late or not at all, they might be hurting your business. Late payments from customers are one of the top reasons why companies get into cash flow or liquidity problems. To record this transaction, you’d first debit “accounts receivable—Keith’s Furniture Inc.” by $500 again to get the receivable back on your books, and then credit revenue by $500. When Keith gets your invoice, he’ll record it as an accounts payable in his general ledger, because it’s money he has to pay someone else. Like all assets, debits increase notes receivable and credits reduce them.

- Notes receivable carry interest charges; thus, when the maturity date approaches, it can be extended if the company wish to accumulate more interest.

- This is the first entry that an accountant would record to identify a sale on account.

- If the client pays as agreed, the team records the payment as a deposit; at that point, the account is no longer receivable.

- Bad debt expense is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible.

- Accounts payable and accounts receivable are key to understanding the financial standing of your business.

Entities that anticipate prepayments in applying the interest method shall disclose that policy and the significant assumptions underlying the prepayment estimates. This disclosure exception should be applied consistently for all restructured loans in a troubled debt restructuring. Identification of any changes to the entity’s accounting policies or methodology from the prior period and the entity’s rationale for the change. The Fenton Company should also indicate the default on the Zoe Company’s subsidiary accounts receivable ledger. When the borrower or maker of a note fails to make the required payment at maturity, the note is considered to have defaulted. In other cases, a customer’s credit rating may cause the seller to insist on a written note rather than relying on an open account.

The disclosure should discuss factors that influenced management’s judgment and the risk elements relevant to their financial instruments. If it is still unable to collect, the company may consider selling the receivable to a collection agency. When this occurs, the collection agency pays the company a fraction of the note’s value, and the company would write off any difference as a factoring (third-party debt collection) expense. Let’s say that our example company turned over the $2,200 accounts receivable to a collection agency on March 5, 2019 and received only $500 for its value. The difference between $2,200 and $500 of $1,700 is the factoring expense.

The second possibility is one entry recognizing principal and interest collection. Accounts Receivable, on the other hand, is the money owed to a company from customers who purchased goods or services on credit. It is recorded and tracked as a liability until it is collected from the customer. For accounts receivable, auditors look at accounts that are past due beyond 120 days. If leaders determine the client can’t or won’t pay, finance needs to remove the amount from AR and charge it as an expense. Auditors use different methods to evaluate the efficacy of accounts payable and accounts receivable safeguards.

Please Sign in to set this content as a favorite.

For example, when the previously mentioned customer requested the $2,000 loan on January 1, 2018, terms of repayment included a maturity date of 24 months. This means that the loan will mature in two years, and the principal and interest are due at that time. The following journal entries occur at the note’s established start date.

Pure Cycle Announces Financial Results for the Six Months Ended … – AccessWire

Pure Cycle Announces Financial Results for the Six Months Ended ….

Posted: Wed, 12 Apr 2023 20:13:01 GMT [source]

However, for large orders, a company may ask for a deposit up front, especially if the product is made to order. Services firms also frequently bill some portion of their fees up front. To calculate DPO, start with the average accounts payable for a given period, often a month or quarter. Once an authorized approver signs off on the expense and payment is issued per the terms of the contract, such as net-30 or net-60 days, the accounting team records the expense as paid. The acid-test is a ratio of the sum of cash plus short-term investments plus net current receivables to total current liabilities.

Right accounting tools and management should be in place for their maintenance. However, a company should be able to draw a line between too-high and too-low receivable values. Some companies offer discounts to customers who pay before a specific date. For that matter, the sales discount and cash account are in debit, and the AR account is in credit.

For finance leaders, excellence in accounting practices, managing cash flow, producing better reporting and maximizing working capital are top of mind, and both AR and AP are fundamental to all of these. “Accounts payable” refers to an account within the general ledger representing a company’s obligation to pay off a short-term obligations to its creditors or suppliers. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Mismanagement of either side of the equation can adversely affect your credit and, eventually, the stability of your business. The interest revenue earned on the note up to year-end is part of that year’s earnings. Because of the revenue recognition principle, a business must record the earnings from the note in the year in which they were earned. Many businesses use accounts receivable aging schedules to keep tabs on the status and well-being of AR. Accordingly, Net Realizable Value of Accounts Receivable is a measure of valuing the accounts receivables of your business. Accounts receivable turnover measures how efficiently your business collects revenues from customers to whom goods are sold on credit.

When the customer makes the payment, there is a journal entry for debit on the cash account and credit on the AR account. The easiest way to handle bad debts is to use the direct write-off method. When you know that a bill will not be paid, you reclassify the receivable balance to bad debt expense. The accounts receivable aging schedule separates receivable balances based on when the invoice was issued.

https://1investing.in/ receivable is recorded as the current asset on your balance sheet. This is because you are liable to receive cash against such receivables in less than one year. The A/R turnover ratio is a measurement that shows how efficient a company is at collecting its debts. It divides the company’s credit sales in a given period by its average A/R during the same period. The result shows you how many times the company collected its average A/R during that time frame. The lower the number, the less efficient a company is at collecting debts.

Do Trade Receivable and Other Receivables Report in the Income statement?

For each business day that passes, a certain amount of fees become earned and non-refundable. Clients often pay fees to a registered investment advisor every four months, billed in advance. They manage all responsibilities related to the accounts, from billing charges, auditing, and reporting to invoices and collections. They are responsible for collecting the company’s and customer’s accounts information.

Some firms charge late cash and cash equivalents after a specific due date, and include the terms of the fee on each invoice. A grocery store or restaurant serves customers who pay by debit card or credit card immediately. Businesses that sell “big-ticket items”, such as airplanes, may not receive payment for months. To assess your performance, compare your turnover ratio to other firms in your industry. The accrual basis posts revenue when it’s earned, and expenses are posted when they’re incurred.

Now, Lewis Publishers purchases this quantity of paper on credit from Ace Paper Mill. In such a case, Ace Paper Mill invoices Lewis for $200,000 (10,000 tons x $20 per ton) and gives Lewis Publishers a Credit Period of 45 days to pay the amount. They are also responsible for resolving issues like debt repayment through customer interactions. They monitor, record, and review all account activities regarding debt collection. They display receivables that are due now and those that are already late.

AP does not include, for example, payroll or long-term debt like a mortgage — though it does include payments to long-term debt. In both the percent-of-receivables method and aging-of-receivables method, the business determines the balance of the Allowance for Bad Debts account based on a percentage of accounts receivable. This target balance is then used to determine the amount of bad debts expense after considering the remaining balance in the Allowance for Bad Debts. Accounts receivable represent the right to receive cash in the future from customers for goods sold or for services performed. Accounts receivable are usually collected within a short period of time such as 30 or 60 days.