Adjusting entries record items that aren’t noted in daily transactions. These items include accumulation (known as “accrual” in accounting) of real estate taxes or depreciation accrual, which need to be recorded to close the books. Your accountant often does these steps or uses professional accounting software to reduce errors. Click here to get started with FreshBooks accounting software. Below are the T accounts with the journal entries already posted. The T-account summary for Printing Plus after closing entriesare journalized is presented in Figure 5.7.

Monthly Financial Reporting Template for CFOs

- Before creating your final report, generate a trial balance, and if things are not adding up, check your work and enter adjusting entries until you are ready to create the final financial statement.

- Your car,electronics, and furniture did not suddenly lose all their value,and unfortunately, you still have outstanding debt.

- The expense accounts and withdrawal account will now also be zero.

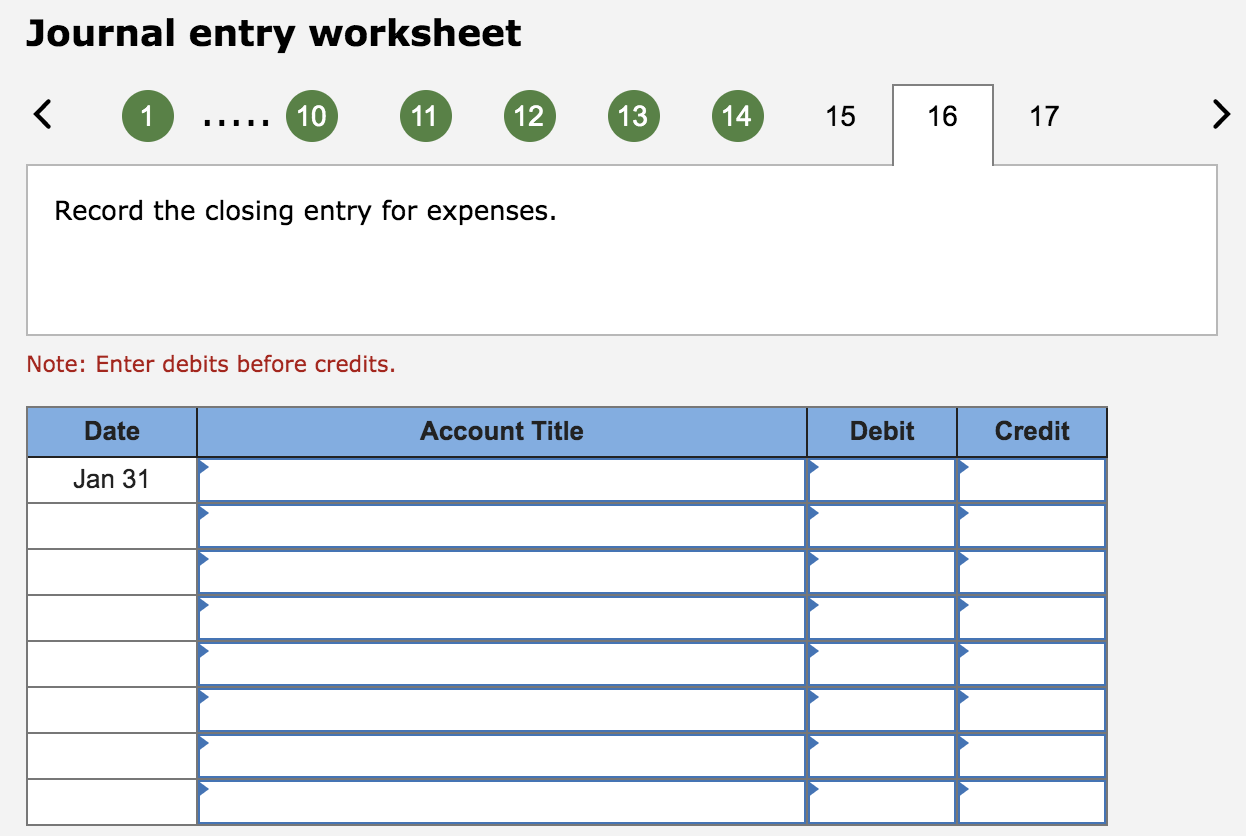

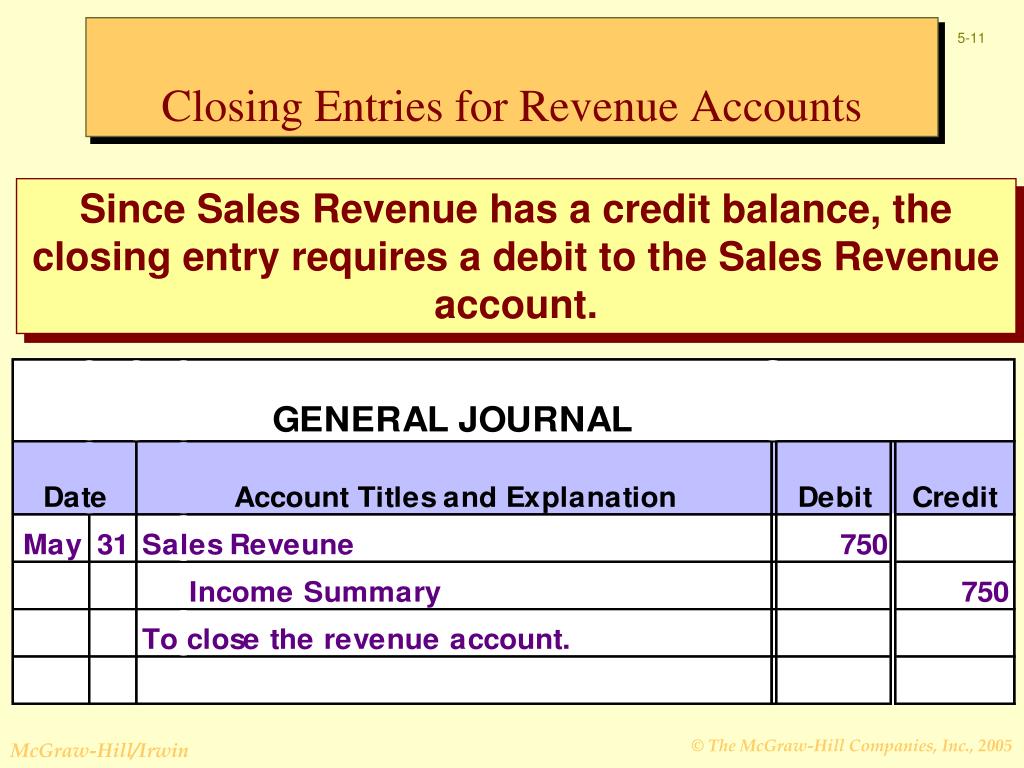

The balance of the Income Summary account is transferred to the Retained Earnings account. Debit the Income Summary account and credit each expense account. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

Closing the Books: Basics & 8 Steps Guide

After the financial statements are finalized and you are 100 percent sure that all the adjustments are posted and everything is in balance, you create and post the closing entries. The closing entries are the last journal entries that get posted to the ledger. After these entries, all temporary accounts (revenue, expenses, dividends) will have zero balances, and the net income and dividends will be reflected in the Retained Earnings account. The trial balance above only has one revenue account, Landscaping Revenue.

What Does It Mean to Close the Books?

A net loss would decrease owner’s capital, so we would do the opposite in this journal entry by debiting the capital account and crediting Income Summary. In essence, we are updating the capital balance and resetting all temporary account balances. Closing entries are necessary to reset the balances of temporary accounts to zero and to update the Retained Earnings account.

If the credits and debits are equal, your accounts balance, and you’re ready to go to the next step. In addition, if the accounting system uses subledgers, it must close out each subledger for the month prior to closing the general ledger for the entire company. In addition, if the company uses several sets of books for its subsidiaries, the results of each subsidiary must first be transferred to the books of the parent company and all intercompany transactions eliminated. If the subsidiaries also use their own subledgers, then their subledgers must be closed out before the results of the subsidiaries can be transferred to the books of the parent company. Since the income summary account is only a transitional account, it is also acceptable to close directly to the retained earnings account and bypass the income summary account entirely. The net result of these activities is to move the net profit or net loss for the period into the retained earnings account, which appears in the stockholders’ equity section of the balance sheet.

Closing Entries

Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into permanent accounts. Temporary accounts are used to accumulate income statement activity during a reporting period.

I imagine some of you are starting to wonder if there is an end to the types of journal entries in the accounting cycle! So far we have reviewed day-to-day journal entries and adjusting journal entries. Remember, dividends are a contra stockholders’ equity account.It is contra to retained earnings. If we pay out dividends, itmeans retained earnings decreases. The remaining balance in Retained Earnings is$4,565 (Figure5.6).

On expanding the view of the opening trial balance snapshot, we can view them as temporary accounts, as can be seen in the snapshot below. A sole proprietor or partnership often uses a separate drawings account to record withdrawals of cash by the owners. Although the drawings account is not an income statement account, it is still classified as a temporary account and needs a closing journal entry to zero the balance for the next accounting period.

Occasionally, revenue and expenses are transferred to an intermediate account called an income summary. Dividends are always transferred directly to retained earnings. This process ensures that your temporary accounts are properly closed out sequentially, and the relevant balances are transferred to the income summary and ultimately to the retained earnings account.

A company will see its revenue andexpense accounts set back to zero, but its assets and liabilitieswill maintain a balance. Stockholders’ equity accounts will alsomaintain their balances. In summary, the accountant resets thetemporary accounts to zero by transferring the balances topermanent accounts. The retained earnings account balance has now increased to 8,000, and forms part of what is the difference between sales tax and vat the trial balance after the closing journal entries have been made. This trial balance gives the opening balances for the next accounting period, and contains only balance sheet accounts including the new balance on the retained earnings account as shown below. The statement of retained earnings shows the period-endingretained earnings after the closing entries have been posted.

The use of closing entries resets the temporary accounts to begin accumulating new transactions in the next period. Otherwise, the balances in these accounts would be incorrectly included in the totals for the following reporting period. Closing entries are typically recorded in the general journal.