The book value of a stock is theoretically the amount of money that would be paid to shareholders if the company was liquidated and paid off all of its liabilities. As a result, the book value equals the difference between a company’s total assets and total liabilities. For example, a company has a P/B of one when the book valuation tracking and recording cash sales in a bookkeeping system and market valuation are equal. That means the market valuation is less than the book valuation, so the market might undervalue the stock. The following day, the market price zooms higher and creates a P/B ratio greater than one. That tells us the market valuation now exceeds the book valuation, indicating potential overvaluation.

Book Value Greater Than Market Value

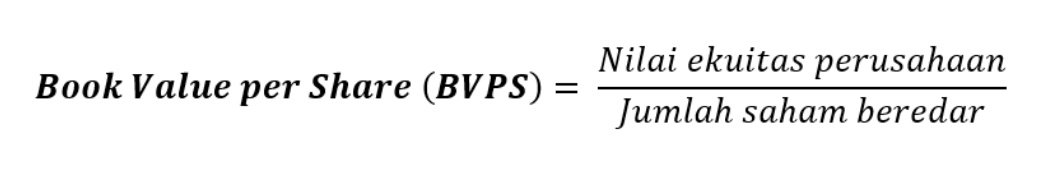

If the company sold its assets and paid its liabilities, the net worth of the business would be $20 million. To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding. For example, if a company has total common equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1. Book value per share is the portion of a company’s equity that’s attributed to each share of common stock if the company gets liquidated. It’s a measure of what shareholders would theoretically get if they sold all of the assets of the company and paid off all of its liabilities. A common way of increasing BVPS is for companies to buy back common stocks from shareholders.

Book Value Per Share: Definition, Formula & Example

Earnings, debt, and assets are the building blocks of any public company’s financial statements. For the purpose of disclosure, companies break these three elements into more refined figures for investors to examine. Investors can calculate valuation ratios from these to make it easier to compare companies.

Market Value Formula

- You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more.

- In this case, each share of stock would be worth $0.50 if the company got liquidated.

- You won’t get this information from the P/B ratio, but it is one of the main benefits of digging into the book value numbers and is well worth the time.

- In other words, it defines the accounting value (i.e. book value) of a share of a company’s publicly-traded stock.

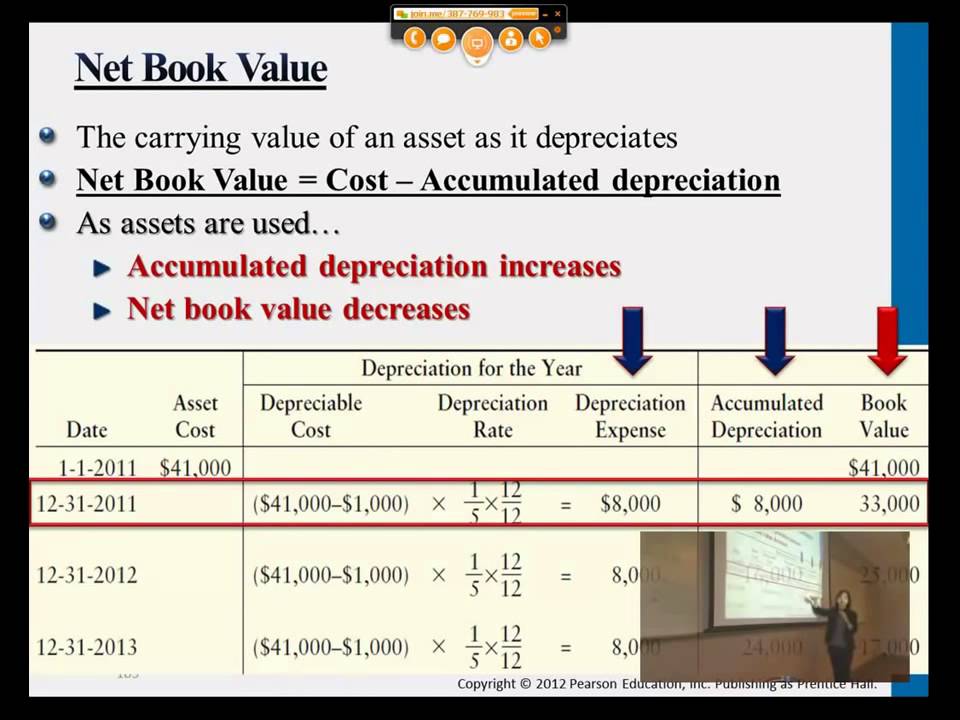

However, the market value per share—a forward-looking metric—accounts for a company’s future earning power. As a company’s potential profitability, or its expected growth rate, increases, the corresponding market value per share will also increase. A company can use a portion of its earnings to buy assets that would increase common equity along with BVPS. Or, it could use its earnings to reduce liabilities, which would also increase its common equity and BVPS. Book value focuses on the balance sheet and compares a company’s assets to its liabilities to determine how much equity would be left over after it fulfilled all of its obligations.

Book Value vs. Market Value: What’s the Difference?

Book Value Per Share solely includes common stockholders’ equity and does not include preferred stockholders’ equity. This is because preferred stockholders are ranked differently than common stockholders in the event the company is liquidated. Book value is the value of a company’s total assets minus its total liabilities. It may not include intangible assets such as patents, intellectual property, brand value, and goodwill. It also may not fully account for workers’ skills, human capital, and future profits and growth. The value of a common stock, therefore, is related to the monetary value of the common shareholders’ residual claim on the corporation – the net asset value or common equity of the corporation.

The Difference Between Market Value per Share and Book Value per Share

In those cases, the market sees no reason to value a company differently from its assets. It is quite common to see the book value and market value differ significantly. The difference is due to several factors, including the company’s operating model, its sector of the market, and the company’s specific attributes. Companies with lots of real estate, machinery, inventory, and equipment tend to have large book values. In contrast, gaming companies, consultancies, fashion designers, and trading firms may have very little.

The two metrics can be compared to each other to help determine whether a stock is overvalued or undervalued. Book value and market value are two fundamentally different calculations that tell a story about a company’s overall financial strength. When the market value is greater than the book value, the stock market is assigning a higher value to the company due to the earnings power of the company’s assets.

This situation suggests a potential buying opportunity, as the market may be undervaluing the company’s actual worth. If quality assets have been depreciated faster than the drop in their true market value, you’ve found a hidden value that may help hold up the stock price in the future. If assets are being depreciated slower than the drop in market value, then the book value will be above the true value, creating a value trap for investors who only glance at the P/B ratio.

The book valuation can also help to determine a company’s ability to pay back a loan over a given time. In the food chain of corporate security investors, equity investors do not have the first crack at operating profits. Common shareholders get whatever is left over after the corporation pays its creditors, preferred shareholders and the tax man. But in the world of investing, being last in line can often be the best place to be, and the common shareholder’s lot can be the biggest piece of the profit pie. Now, let’s say that Company B has $8 million in stockholders’ equity and 1,000,000 outstanding shares.

This is why it’s so important to do a lot of research before making any investment decisions. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond.