A gravestone doji is a bearish reversal signal with a small candle body with a tight open and close, then a long upper shadow. The appearance of a gravestone doji typically suggests that a trend is near a major turning point and could lead to a strong pullback. A valid entry signal to buy this market only appeared after the second doji forex pattern. If you look closely, then the first doji candlestick (oval on the left) did not break below the previous low (red X on the far left).

- Similarly, efforts to crash the prices from the sellers’ end get foiled by the buyers.

- Despite its potential insights, the Doji pattern has some limitations.

- The Hammer Doji is formed after a long downtrend and can be identified on the chart by looking for the horizontal wide body line that crosses the other line and then turns.

- The doji forex candlestick, on the other hand, forms when the closing price is virtually the same as the opening price and looks like a cross or plus sign.

- In this article, we’ll explain why inflation impacts the stock market and take a closer look at how the stock market has reacted to inflation in the past.

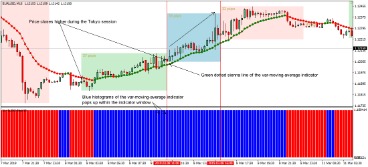

The price chart below shows a long-legged doji candlestick pattern, which could help to signal a short-term top following a brief rally. Since this candle shows a small difference between the open and close price, it is also called a spinning top. The Doji candlestick pattern is a valuable tool for understanding market sentiment and potential trend reversals. Whether it’s the Neutral Doji, Dragonfly Doji, or Gravestone Doji, each pattern provides unique insights into the balance of power between buyers and sellers.

Mastering the Trading Floor: 8 Expert Eye-Opening Insights

So, for example, when Bitcoin opens and closes at $20,000 on a particular day even if its price seesawed between $25,000 and $15,000 throughout the given24-hour period. From beginners to experts, all traders need to know a wide range of technical terms. The spinning top is the same as a common doji, except that the spinning top has a small real body, whereas the doji should have little to no real body. In other words, data-driven trading strategies expect reversals around these key doji formations. The chart image below shows the trade levels that could have been used to sell this market. While there are such things as Bullish candlesticks, Bearish candlesticks, Reversal candles etc.

- These are possible areas of reversal, but we’ll want a signal that the market is going to retrace before we consider trading.

- The spinning top is the same as a common doji, except that the spinning top has a small real body, whereas the doji should have little to no real body.

- Doji patterns are often a component of larger candlestick patterns such as the evening or morning star doji.

- In technical analysis, a Doji is a type of candlestick pattern that can be used to predict future price movements.

- The Doji candlestick pattern works best in a trending market and for traders willing to wait for a confirmation on the signal.

77% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Get our free Candlestick Cheat Sheet PDF with the most powerful candlestick combinations. types of doji candlestick HaiKhuu LLC was officially established in January 2018 by the Founder and CEO, Allen Tran. Allen and his team of professionals are actively working together to help the average retail trader become successful and profitable in the market. TradingView is currently providing a 30-day free trial for their premium subscriptions.

As mentioned above, rallies and dumps need conviction to continue, and a doji candlestick is counterintuitive to that. Spinning tops indicate weakness in the current trend, but not necessarily a reversal, whereas Doji patterns can signal potential trend reversals. Most technical analysts are aware that technical indicators are not foolproof strategies to win over the market. Key indicators, like Doji candlestick patterns, should be analysed with other market trends and indicators.

Latest Financial market insight articles

Whereas the High and Low make up the thin parts, known as the Shadows (some call it the Wick). HaiKhuu runs some of the largest communities of stock traders on Facebook, Discord, and TikTok. With over a quarter-million retail traders in the HaiKhuu Trading communities, we have been able to help out hundreds of thousands of stock traders. We can use the Fibonacci tool for our maximum loss and target profit here, too.

Price analysis 5/12: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC – Cointelegraph

Price analysis 5/12: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC.

Posted: Fri, 12 May 2023 07:00:00 GMT [source]

However, when it appears in an uptrend, it requires additional confirmation by other candlestick patterns. A dragonfly doji has a long lower shadow, but the upper shadow is very short or absent, so it has a more bullish character. In conclusion, the Doji candle pattern is an important tool for crypto traders looking to identify potential trend reversals. Doji can be used as a standalone indicator or in combination with other technical analysis tools to make informed trading decisions.

What does Doji indicate?

They can signal a coming bullish breakout above an area of resistance after it has been tested several times. While a doji is usually a sign of a reversal, a spinning top is usually a sign of continuation. The pattern tells traders that there is uncertainty in the market.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFD and Forex Trading are leveraged products and your capital is at risk. Please ensure you fully understand the risks involved by reading our full risk warning. And you now also know that this indecision pattern is often a sign of volatility contraction, ready to break up or down for your profit. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

How to Trade the Doji Candlestick Pattern

In case it appears on a downtrend, the entry point for a long position should be at the breakout or high of the Doji candle. Placing stop-loss is critical to mitigate risk in a trading position. For the neutral Doji, positioning the stop-loss above the high level of the candle for a short trade and below the low for a long position can be beneficial. Notably, the Doji is a bearish signal if the closing price is below the middle of the candle, especially if it is close to resistance levels. Conversely, if the closing price is above the middle of the candle, it is bullish, as the formation resembles a bullish pin bar pattern.

What Is a Candlestick Pattern? 9 Popular Candlestick Patterns Used … – MUO – MakeUseOf

What Is a Candlestick Pattern? 9 Popular Candlestick Patterns Used ….

Posted: Mon, 05 Dec 2022 08:00:00 GMT [source]

If you want to improve your technical analysis knowledge to better develop trading strategies, you need to grasp candlestick chart patterns and all types of Doji candles. Doji is the pattern of Japanese candlesticks that reflects indecision in the stock market. We will help you to recognize them and learn how to interpret them in financial markets trading.

A short line can be a spinning top if the real body is in the middle of the range. The opening and closing prices are almost identical, occurring near the midpoint of the day’s price action. In other words, a common doji must not close near the high or low, and the range must be the same or smaller than prior candles.

The time frame can impact the significance and reliability of the Doji pattern. Generally, the pattern is more reliable on higher time frames, as it represents a more significant period of indecision or potential trend reversal. However, it’s essential to combine the Doji pattern with other technical indicators and tools, regardless of the time frame.

However, a hammer candle has a long lower shadow that is almost twice the size of a real body. Usually, following a price decline, a hammer candlestick appears, indicating a potential future reversal. It signifies a candlestick pattern’s bullish reversal, which typically happens at the bottom of downtrends.

Types of Doji patterns and how to trade them

Technical analysis can be used when analysing doji candlestick patterns in order to signal potential trading opportunities. Now that we know some technical analysis concepts and questions to keep in mind, we will look at the various doji chart types and discuss some ideas on how to trade them. The Doji candlestick pattern is a vital tool in technical analysis, representing a trading session in which the open and close prices are virtually equal. This pattern can signal potential trend reversals or indecision in the market, making it essential for traders and investors to understand its significance. If you are new to candlesticks check out our guide on how to read candlesticks. A dragonfly doji is a bullish doji candlestick reversal pattern with a small candle body featuring nearly the same open and closing price.

No matter your experience level, download our free trading guides and develop your skills. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. 4-Price Doji is a horizontal line indicating that high, low, open and close were equal. In a “Doji Candlestick”, the Open and Close price are the same (refer to image “Doji Candlestick”).